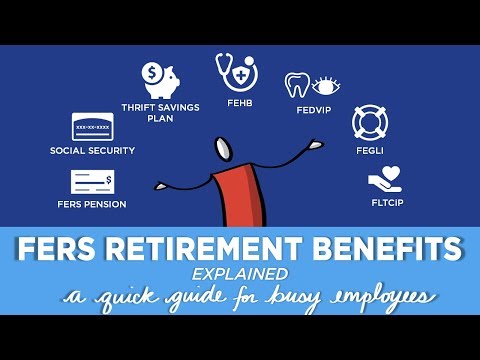

Welcome to FERS retirement benefits explained, a quick guide for busy employees. If you work for the government, you must have a great retirement. It's a struggle for a lot of employees to nail down exactly what FERS, which stands for Federal Employees Retirement System, includes, what the rules are, and how much it will cost them. Plus, it doesn't help much that it's time-consuming to track down the information and then trying to understand the benefits accurately, all while you're working a demanding day job. I'm going to make it easier to understand and remember. This video is brought to you by the FERS blueprint online FERS retirement training, and I'm Kelly Munroe, creator and chief. You know, we know how hard it is to get into a retirement class, and that's why I decided to take the reverse retirement training that I've been doing for years and years at agencies, and I turned it into simple video lessons for online retirement training. I call it the FERS blueprint. It's available online, and there's no more missing out on training. By the way, stay tuned, because at the end of this video, I'll tell you how you can get a one-page FERS retirement guide with all seven benefits on it. It's simple, and it's easy, and it's all on one page. So, as a FERS employee, you have seven distinct retirement benefits to help you retire comfortably. It's helpful to think of the benefits in terms of what they do for you in retirement. These first three benefits are income-based, which means money in your pocket. The next four benefits are insurance-based, which means rainy day protection for you and your family. Of course, each benefit is subject to eligibility requirements. Let's start with the money in your pocket, the income benefits. First,...

Award-winning PDF software

Sf 2801 eligibility Form: What You Should Know

Application for Immediate Retirement CARS. The first section is for a retiree who works for the executive branch as an “employee in the executive branch” i.e., a federal employee at any executive department or government agency, a state government employee or a local government employee. For a person who has retired from one of the other federal agencies, it is referred to as “civil service, except that for a person who is retired from a civil service agency, SF 2801 may be completed and signed by the individual's last employer prior to retirement.” If you have any questions about making a retirement deposit or requesting a redeposit of a deposit, contact the appropriate CAR, the appropriate U.S. Treasury, or the person who applied for an immediate retirement. If you work for the federal government, you may obtain an additional SF 2801 from any of the following: U.S. Office of Personnel Management Department of Treasury U.S. Postal Service Treasury-Post Office U.S. National Institute of Standards and Technology Employee Benefits Security Administration (E-mail: JSTOR, PO Box 657, Reston, Virginia 20190) The “Employee Benefits Security Administration” website has information on applying for an immediate retirement. The page also has a link to the Federal Register Notice for this information and other information. It is unlawful to make a false statement or attempt to lie in order to obtain an immediate retirement. (Title 4, United States Code, Section 1001 (c)(4)). The term instant retirement means the individual has been appointed to receive retirement benefits under this chapter after an approved date and payment or deposit (but may not wait longer than 45 calendar days to make a decision if the decision is to withdraw a deposit) and has not received payment. Payments may not be made prior to the time appointed, even though there remains an eligibility period. The Federal Retirement Thrift Investment Board (NTSB) may require that an immediate employee make an estimated or actual deposit or redeposit before the effective date of the final rule. However, once the initial deposit has been made or redeposited, no additional payments or redeposits will be considered until the deposit is reversed, whether after the effective date of the final rule or at any reasonable time. A “final rule” is the regulation that implements the regulation in question.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sf 2801, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sf 2801 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sf 2801 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sf 2801 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sf 2801 eligibility